Are you looking for a cheap vacation trip? Instead of spending so much time online looking for affordable family vacations, you can pay for this by earning credit card points and miles. You might have heard people say, “We flew to Hawaii for almost nothing!” or “We stayed in a luxury hotel completely free with points.” That probably made you think, “That sounds like a scam” or “That’s only for people with huge budgets or frequent travelers,” right?

I used to think earning points and miles was complicated or only for the wealthy. But when rising travel costs made trips seem out of reach, I started researching. That’s when I discovered the power of credit card points and miles. Thanks to these strategies, my family has flown to Japan and France, vacationed in Hawaii, and stayed in luxury hotels—all for almost nothing.

This beginner’s guide to earning travel points is designed especially for those looking to save money on family vacations. No complicated credit card terms, no overwhelming details—just simple, practical steps to help you take your first step toward nearly free travel. What once felt impossible is now part of our routine. Read on, and you can do it too!

*This page contains affiliate links. If you sign up through these links, I may earn a small commission at no extra cost to you. Thank you for supporting the blog!

Learn how to earn and use credit card rewards for free travel!

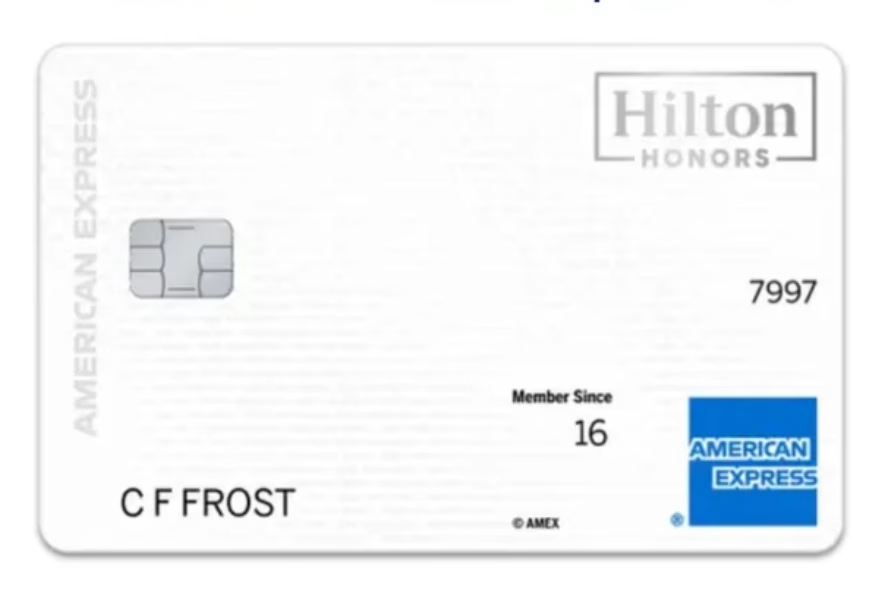

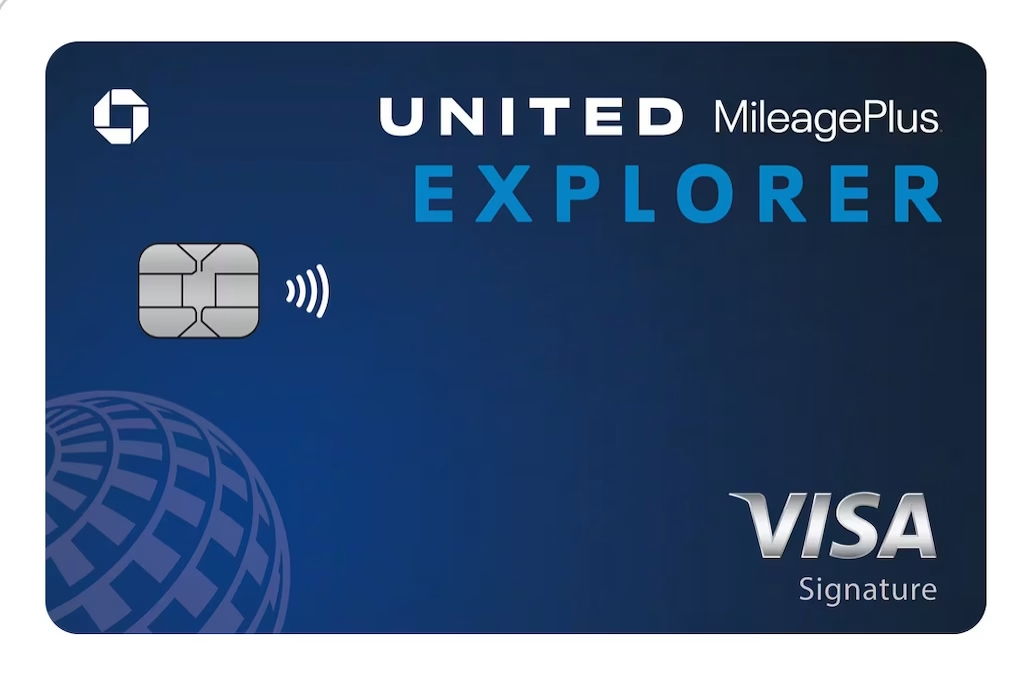

In the U.S., many credit cards offer welcome bonuses as an incentive for new customers. These bonuses can include tens of thousands of points or miles if you spend a specific amount (called the “minimum spend”) in the first few months after opening the card.

For example:

How to Meet the Spending Requirement Without Overspending

Once you’ve picked a card, it’s time to meet the spending requirement (minimum spend) to unlock your bonus points. Here’s how to do it without overspending:

You don’t need to spend more than you already do.

Pro Tip: Always pay your balance in full each month to avoid interest charges. This is key to making the most of your points without adding debt!

Tips to earn more points without overspending!

You can earn even more points by working together:

Instead of adding your family as an authorized user on your card, have them open their own card to earn their own welcome bonus. Use referral links! Many credit card companies offer referral bonuses if you refer someone to open the same card.

Here’s an example of how this works:

Total points between us in just a few months? Over 290,000 points, which could cover multiple round-trip flights(depending on the destinations), free hotel stays, and more!

How to continue earning points and miles year after year!

Once you’ve completed the first round of bonuses, you can repeat the process with new cards over time.

Manage your travel credit cards wisely for long-term benefits!

When your credit card’s annual fee is charged, take the time to decide whether it’s worth keeping or if you should cancel it. If the benefits don’t justify the cost, canceling unnecessary cards can help you manage your expenses. However, make sure to keep the card for at least a year to maintain a healthy credit score.

FAQs: answers to common questions about travel rewards!

Here are some common questions you may have when you open multiple credit cards each year.

1. Won’t opening credit cards hurt my credit score?

Yes, the score drops, but if you manage your accounts responsibly, it’s going back or even higher. By paying your bills on time and keeping balances low, your credit score can actually improve.* This is how my husband and I keep our credit score higher than 800.

2. How to meet the credit card minimum spend

Start with smaller spending goals. Many beginner-friendly cards only require $500 or $1,000 in the first three months. Check below which has my top three recommended cards for beginners.

Pro Tips: If you need to spend several hundred dollars to complete the minimum spend, I would buy some gift cards for shopping with grocery stores or Home Depot, somewhere you often shop in advance for yourself.

3. Why Is This an Amazing Opportunity?

Credit card points and miles are a unique perk of living in the U.S. Most other countries don’t offer such generous rewards, so if you’re an American resident, this is your chance to take advantage.

4. Should You Keep a Credit Card with an Annual Fee?

After one year of having a credit card, you’ll need to decide whether to keep it or cancel it. The most important question to ask yourself is: Are the benefits worth more than the annual fee?

If the card gives you valuable perks that you would use—like free hotel nights, travel credits, or airport lounge access—and those perks are worth more than what you’re paying, then it makes sense to keep the card. In our case, we keep cards that provide good value, even with the annual fee.

On the other hand, if the benefits aren’t useful or don’t add up to more than the fee, it might be better to cancel the card. A good strategy is to wait until the annual fee is charged and then decide. Many credit card companies allow you to cancel within 30 days after the fee is posted and get a full refund.

However, keep in mind that closing a card within the first year can negatively impact your credit score. If you’re considering canceling, always check your benefits and timing to make the best decision.

Top 3 Best Travel Credit Cards for Beginners

If you’re ready to begin your points and miles journey, these are my top recommendations for beginners:

*These numbers were accurate as of Jan 2025

Chase Airline Partners

Chase Hotel Partners

Turn your travel dreams into reality with points and miles!

I used to think frequent travel to affordable destinations was impossible for a regular family like mine. But thanks to credit card points and miles, and the airline rewards program, we’ve been able to visit places we had only dreamed of thanks to the nearly free flights with credit card points and hotel stays, making our travel much cheaper. This method can also help save you time instead of looking for the cheapest international flights.

If you’re ready to start, all it takes is one card to begin your journey. Pick a beginner-friendly card, meet the spending requirement, and watch as your points add up. You might just find yourself booking a trip to Hawaii, Japan, or beyond sooner than you ever imagined!

If you have any questions about points and miles that are holding you back, ask me—I’m here to help! Let’s make it happen!

Happy travels,

Tomo

You Might Also Like

Hilton Paris Opera: One of the Best Hotels in Paris France with Points

Wondering where to stay in Paris, France? We review Hilton Paris Opera—one of the best hotels in Paris for location, comfort, and smart point use.

Luxury for Less: Maximizing Value with Amex Platinum’s FHR

Thinking of the Amex Platinum Card? Discover how to enjoy luxury hotel stays affordably with FHR benefits and insider tips!

How Global Entry works: A complete Guide for Families

Skip airport lines with kids! Learn how Global Entry works for families, how to get the fee reimbursed, and if it’s worth it for your next trip.